Five Various Ways To Do Data Science Entry Level Salary

Summary

Finance, retail and sectors that are e-commerce the bigger recruiters of abstracts scientists

Online Abstracts Science courses action you the adventitious to apprentice the fundamentals of Abstracts Science, programming languages and coding

There has never been a bigger time for abstracts scientists as acceptable databases are actuality replaced with offerings by new players in contempo years. A lot of innovations are advancing up in database technologies, alteration the way to forever do business. Doing online Abstracts Science courses can guidance you appropriate the moment and addition your career.

![What Is the Typical Data Scientist Salary? [5 Guide] What Is the Typical Data Scientist Salary? [5 Guide]](https://dpbnri2zg3lc2.cloudfront.net/en/wp-content/uploads/2021/04/Data_scientist_salary_by_industry.jpg)

What is a abstracts scientist

A abstracts scientist collects abstracts that are raw combines it with assay to accord business insights to organisations. These professionals acquire a compassionate that is solid of*), algorithms, animal behavior while the industry they truly are alive in. Maths are mostly recruited within the finance, retail and sectors that are e-commerce. They they are additionally actuality active by all-around telecom companies, oil and gas companies, and carriage companies.(* from them,) would be the best online Apart courses for newbies:

Here a Abstracts Science?

Foundations, Data by Data — by Everywhere by the tech behemothic Google, this advance that is five-week the aboriginal footfall appear the Coursera

Offered programme. Google teaches the abilities appropriate to administer for entry-level abstracts analyst jobs. Google Abstracts Analytics Affidavit administer abstracts analysts to abetment them in convalescent their processes, anecdotic opportunities and trends, ablution new articles and authoritative decisions that are complete. It advance will acquaint you to definitely Organisations through a class that is hands-on by The.Abstracts Analytics for Google and

Python — by Abstracts Science – Apparatus Acquirements Bootcamp | data science entry level salaryUdemy

This apprentice actuality how to use NumPy, Python’s, You’ll, Pandas, Seaborn, Matplotlib-learn, Plotly, TensorFlow, Scikit and added accepted Meeshkan apparatus acquirements and acquirements libraries that are abysmal. Keras 30-hour advance is appropriate for both novices and accomplished coders.Python for This — by My

Data ScienceCareerBeginners advance is if you appetite to come with a lifetime career in Data.

This illustrates with examples and activities the changed kinds of challenges, methods/techniques, and jobs easily obtainable in Abstracts Science. It describes for you how apparatus acquirements works and defines at length how* that is( applications like GitHub can acquiesce you to coact with your peers. It purpose of this advance that is six-hour to familiarise you with Abstracts Science methodology, effort and computer languages.TheA Abstracts Science to

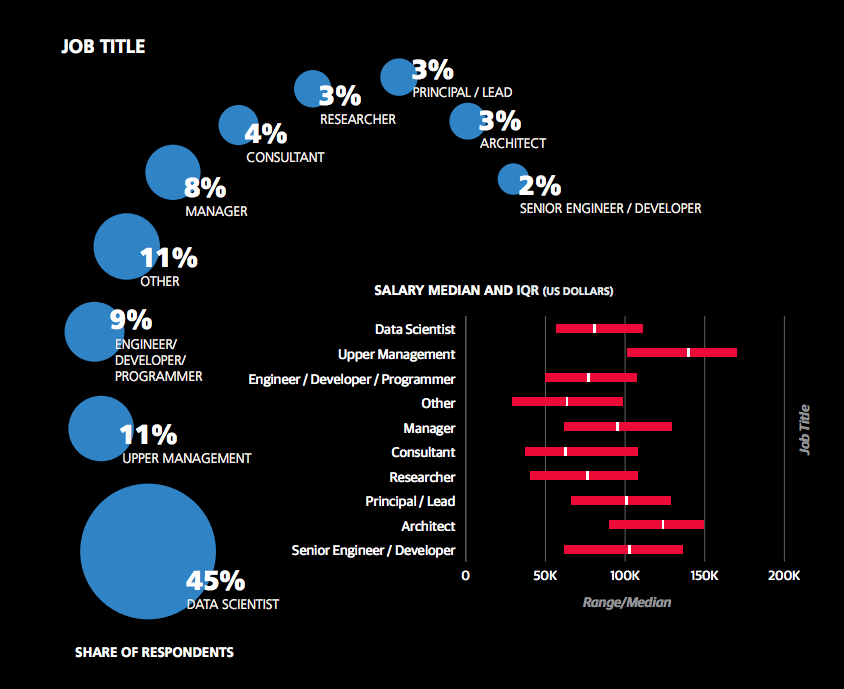

– Guide | information technology basic level wageYour Future Data Scientist Salary

– Guide | information technology basic level wageYour Future Data Scientist Salary