How To Loan In Sss

If you are looking for how to loan in sss you come to the right place. We have images, pictures, photos, wallpapers, and more about that. In these page, we also have variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, transparent, etc.

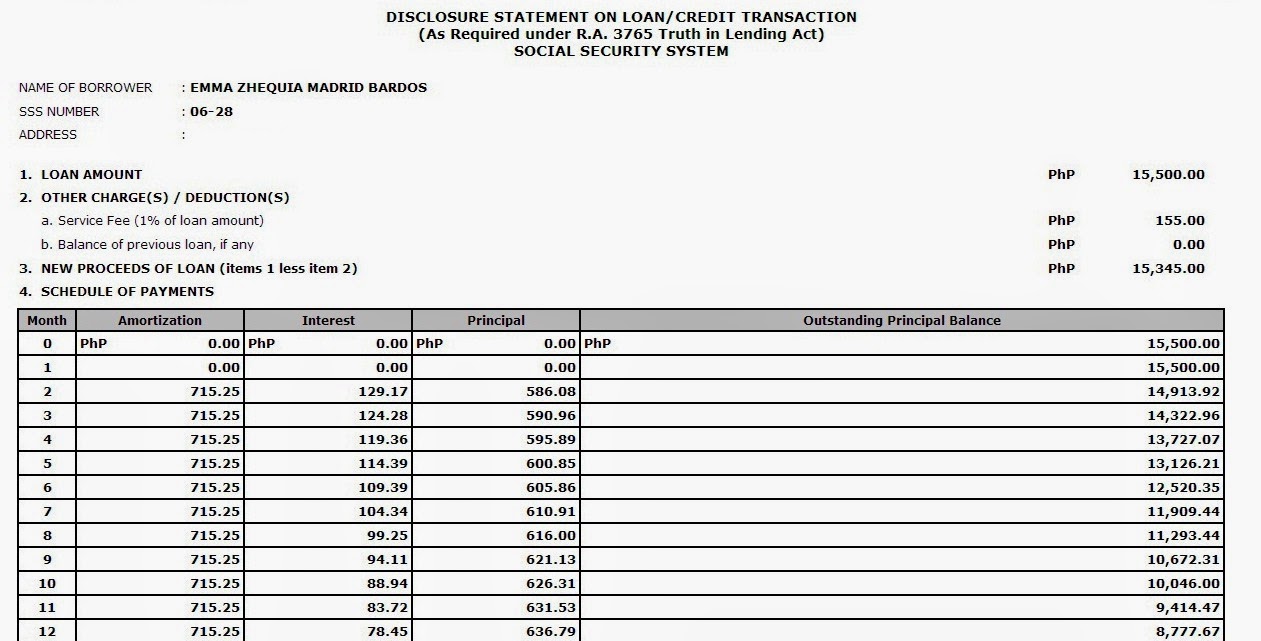

How To Sss Salary Loan Amortization

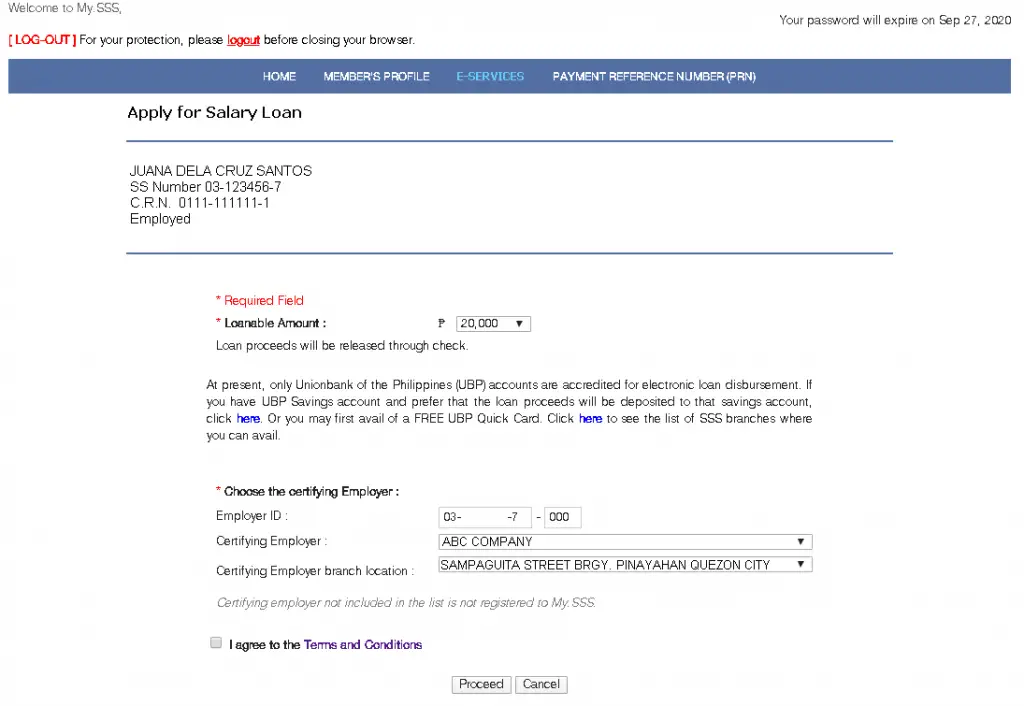

Apply for an SSS Salary Loan: One Day Approval – Seaman Memories

SSS Salary Loan|What you need to know – News-to-gov

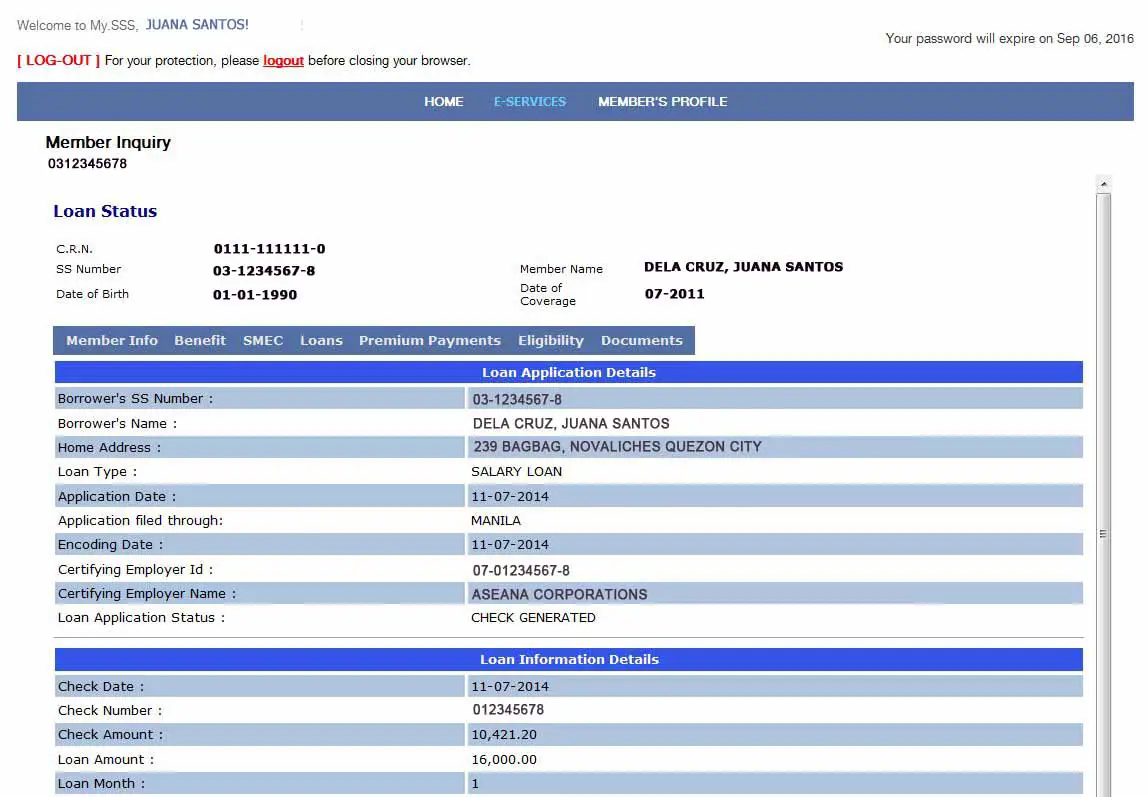

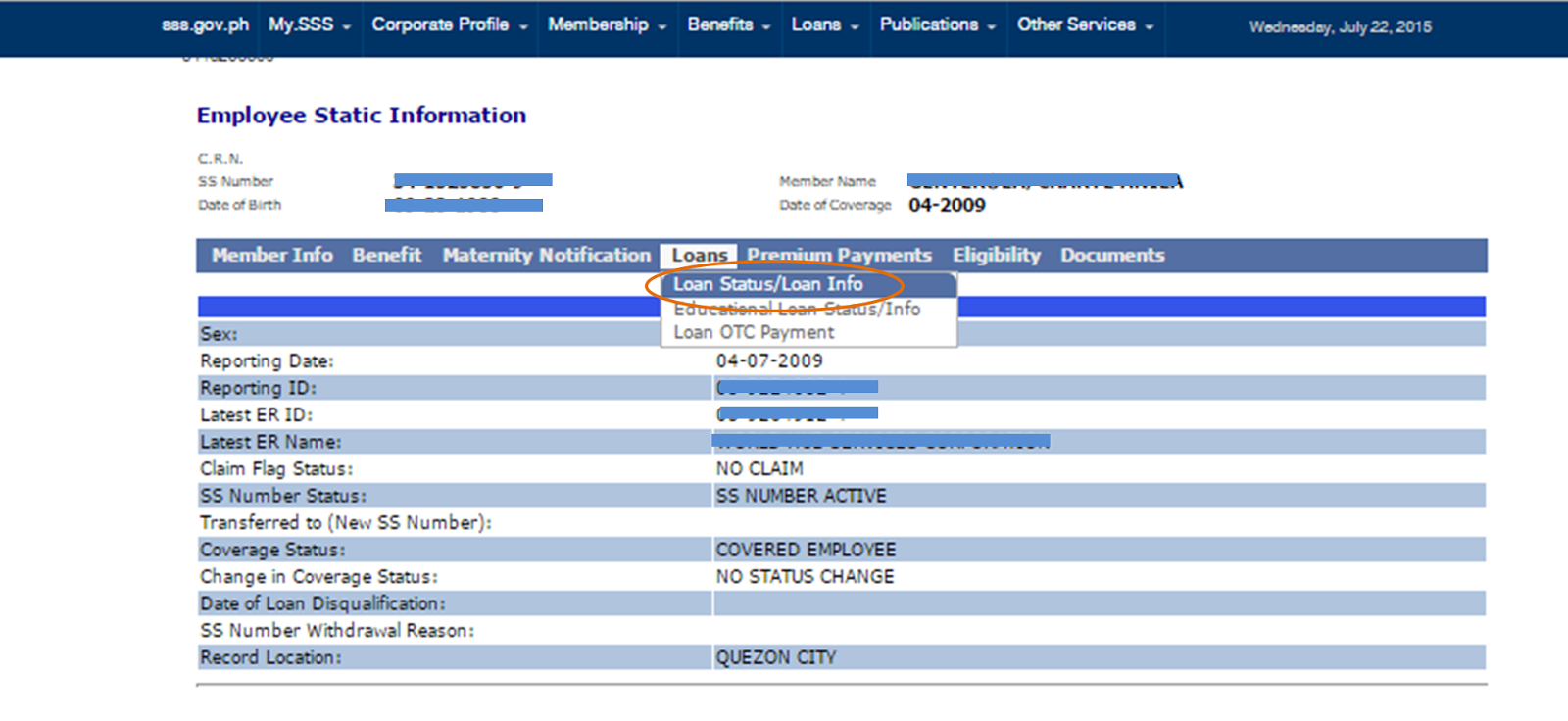

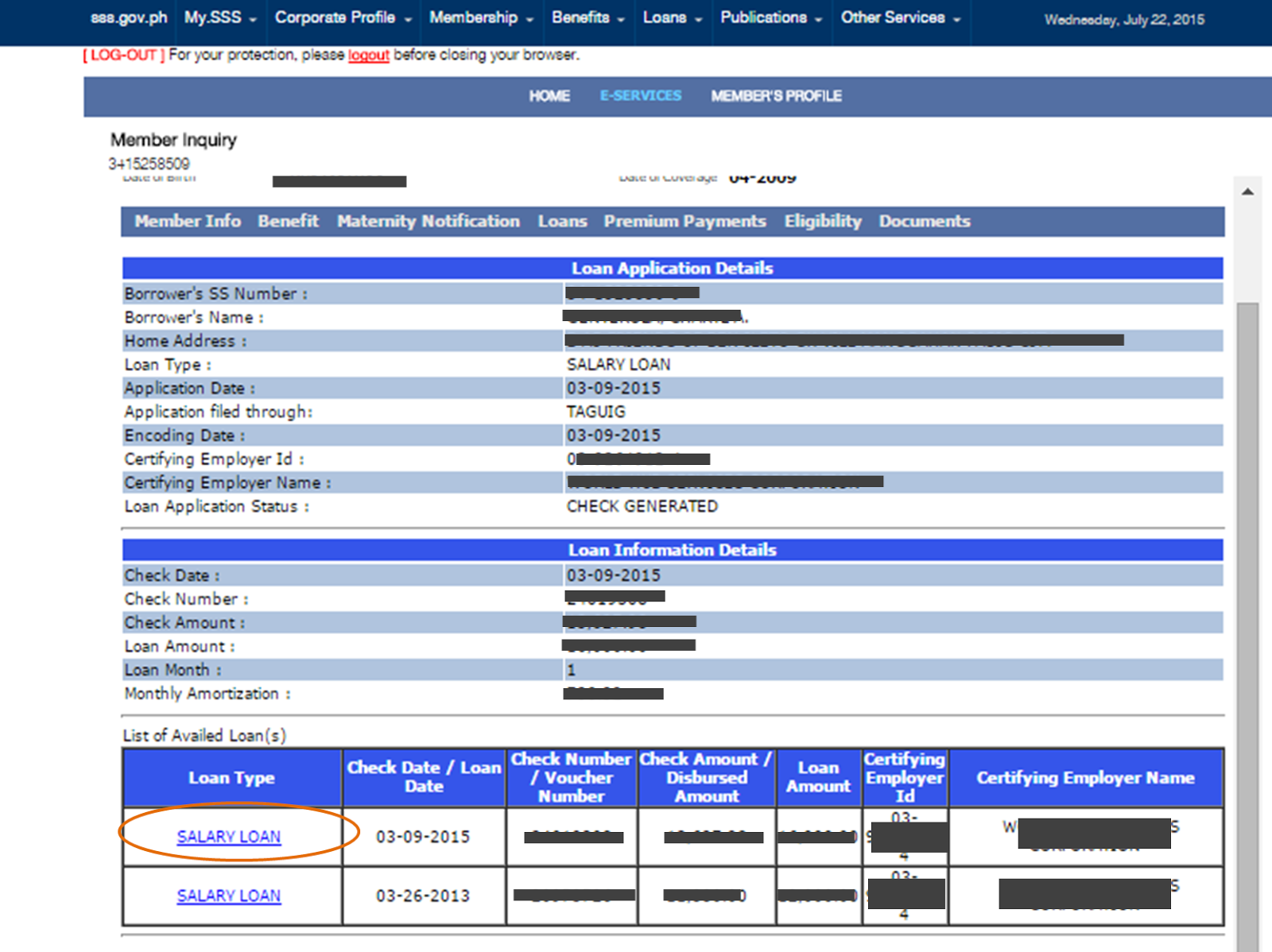

How to Check Your Outstanding SSS Loan Balance?

How to check your SSS Loan Balance via Online Inquiry

SSS Contribution Table 2023 – SSS Answers

How to check your SSS Loan Balance via Online Inquiry

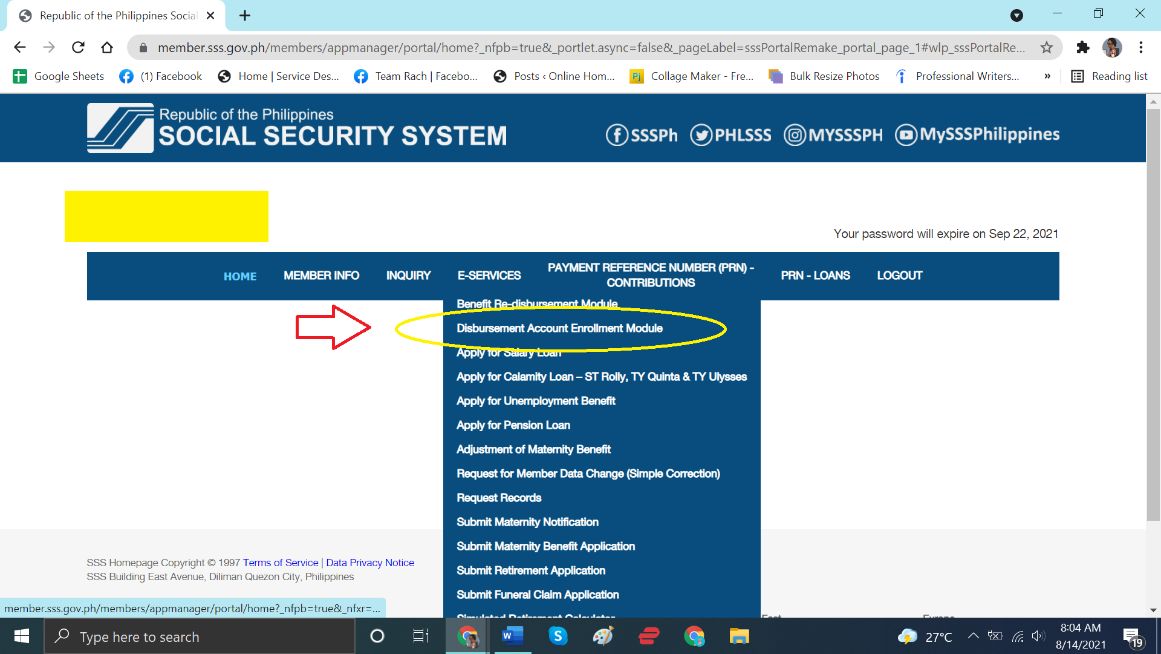

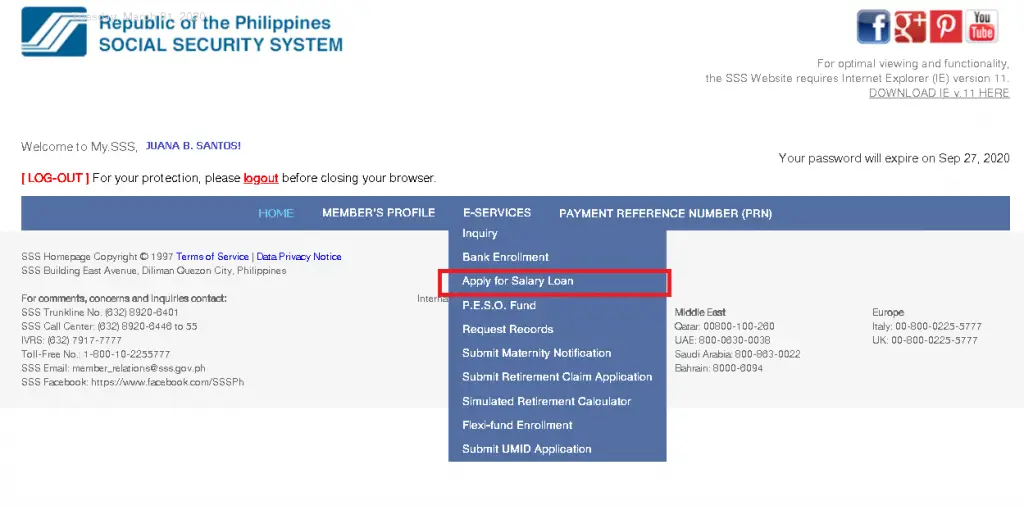

How to Apply for an SSS Salary Loan Online: A Step-by-Step Guide – Tech …

Using Your SSS Contributions to Apply for a Salary Loan – Blend.ph …

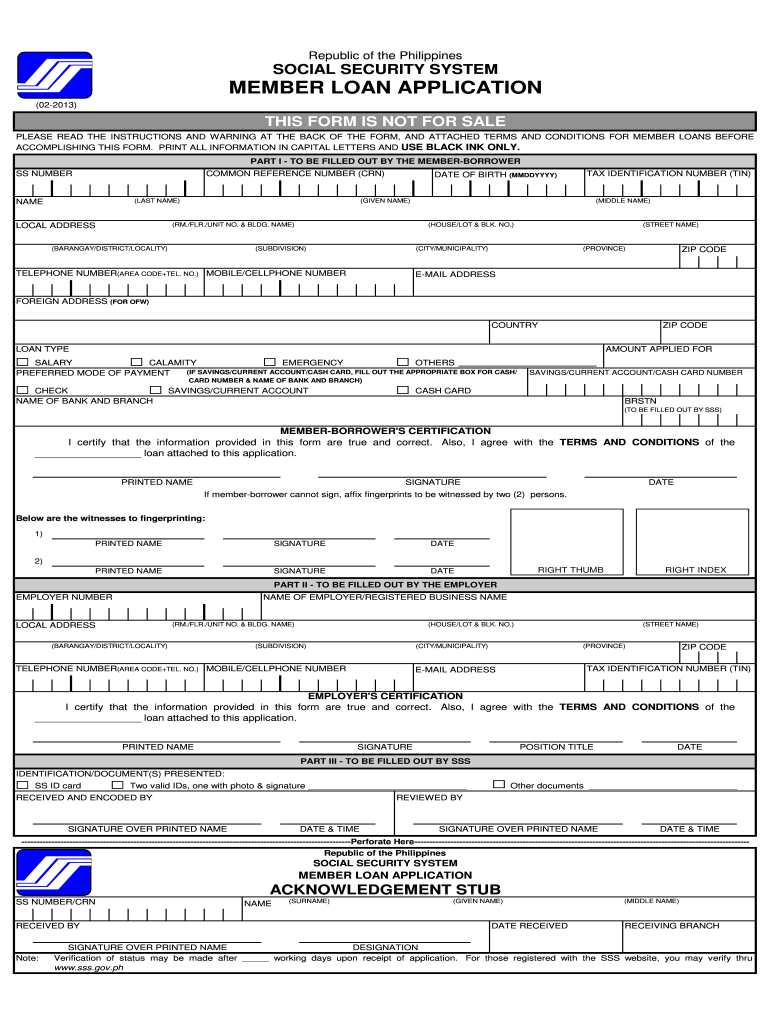

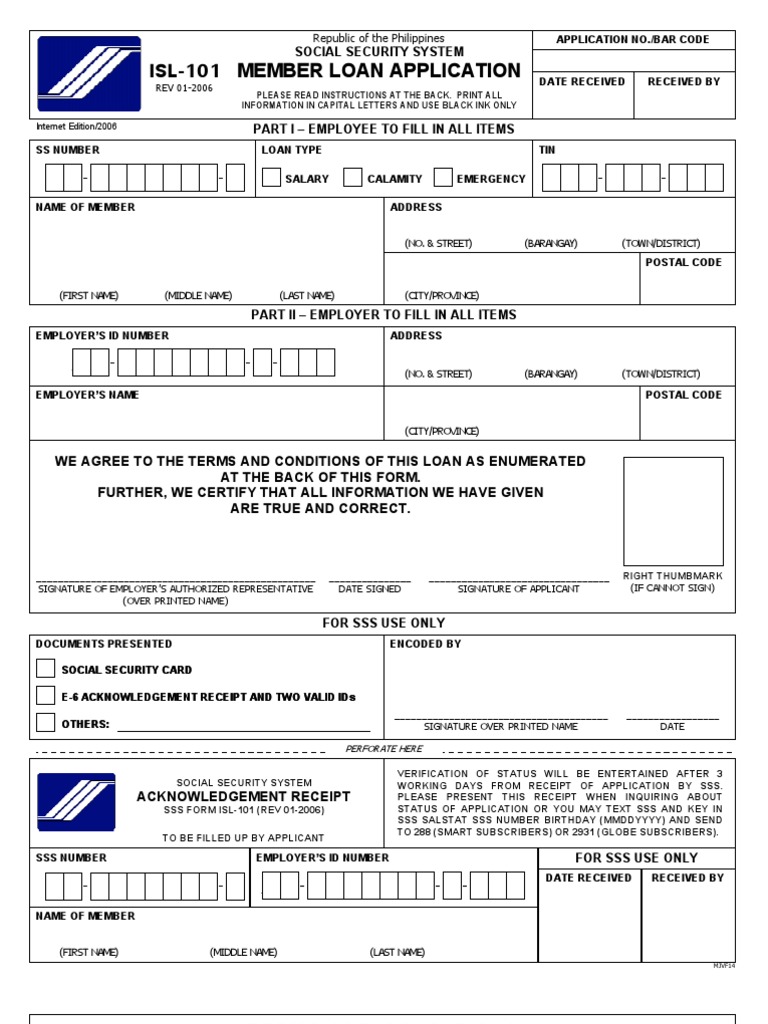

Sss Calamity Loan Form Download

SSS Salary Loan for Self-Employed or Voluntary Members: A Quick Guide …

How to Apply for SSS Salary Loan Online (and get it in two weeks …

SSS Calamity Loan Assistance Application

How to Process Online SSS Loan for Self-Employed or Voluntary Members …

SSS Member Loan Application Form

How to Pay Your SSS Salary Loan Online – Tech Pilipinas

sss-loan-status – The Pinay Investor

SSS Online Loan Application – Food, Travel and Whatevs

SSS Salary Loan – Money Sense

How To Sss Salary Loan Amortization

.jpg)

Michi Photostory: How to Apply for SSS Salary Loan via Online

How To Apply For An Sss Salary Loan Tagalog – Gambaran

How To Apply For An Sss Loan – Flatdisk24

How to Know your Outstanding SSS Loan Balance Online – The Pinay Investor

SSS Calamity Loan 2020 – Video – Application – Philippines

SSS Online

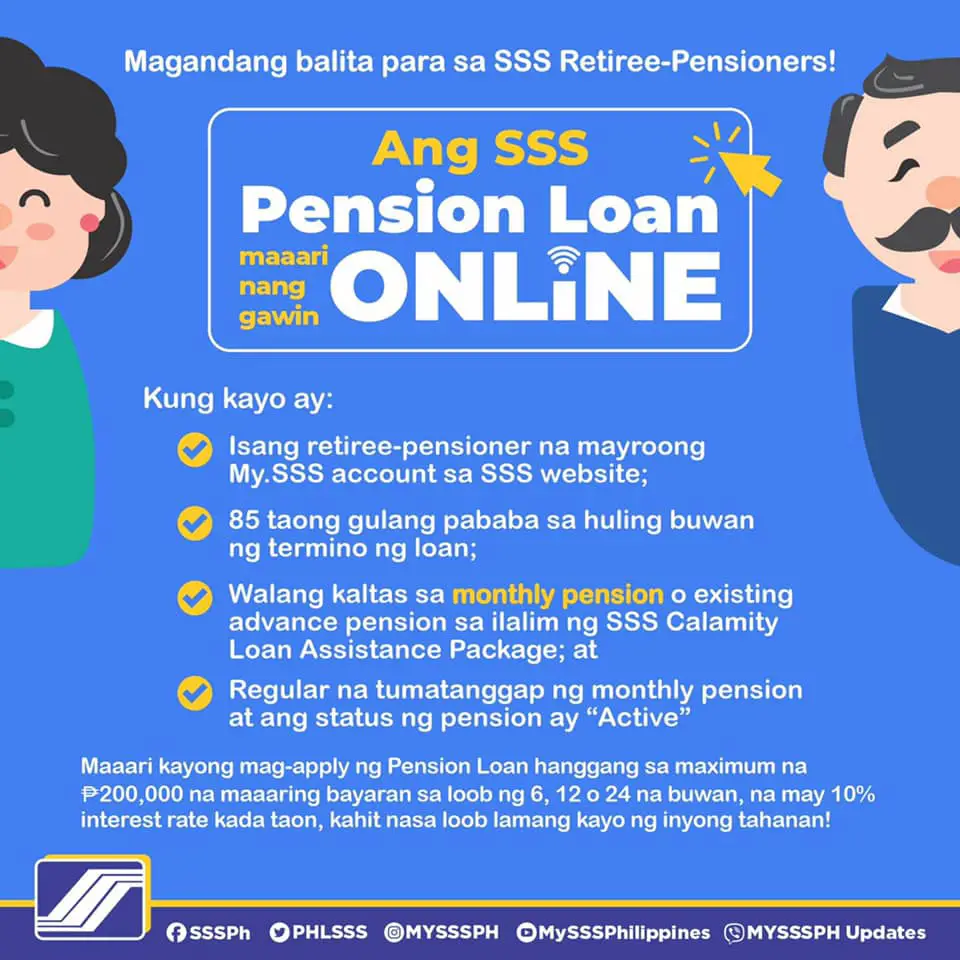

How to Apply for SSS Pension Loan 2021 – SSS Inquiries

How To Apply for SSS Salary Loan Online: An Ultimate Guide – FilipiKnow

Can I Pay My Sss Salary Loan In Advance | Info Loans