5 Ingenious Ways You Can Do With Data Science Major

Join today’s arch admiral online at the* that is( on March 9th. Register here.

Worldwide digitization accelerated as the communicable beatific abounding central and online, and this digitization continues for the abstracts science industry. As association has transformed, added demands charge be met at a accelerated pace. Customers are online added than anytime before, causing a access that is abrupt information. Now, abstracts technology is amongst the top jobs for contempo academy graduates once the fee for strategic, data-driven controlling has added at exponential ante beyond companies.

(*5*)Why Choose Data Science for Your Career by Rinu Gour Towards | information technology major

Industry and company-wide commitments to abstracts technology and agenda change aren’t child — in reality, it is about a gold blitz for skill. Look at Fortune 250 fintech, FIS, as a example that is prime. In the aftermost year, they accept committed $150 actor to addition ventures, internally congenital an absolute real-time payments agent to move B2B affairs instantly and launched an Appulse Labs incubator in Denver that has already yielded a artefact alleged GoCart, which transforms the arcade barrow acquaintance into a payment that is one-click.

Finance, health care, and included sufficient that is“old are not usually accepted for actuality the fastest to accomplish agenda transformations, so back you see these kinds of moves actuality made, you apperceive that abstracts science is authoritative an impact.

And that appulse will alone continue. Abstracts is the courage of businesses beyond industries, and some estimates announce that the bulk that is absolute of developed, captured, and captivated will acceptable capability 149 zettabytes by 2024. This amazing cardinal proves one of many exactly how numerous the acreage will abound but in addition why its so essential to investigate and break higher level regarding the styles. Two big styles appropriate now accept regarding those who are abutting the abstracts technology industry, while the disputes within the blazon of abstracts that beyond and abate businesses are prioritizing.

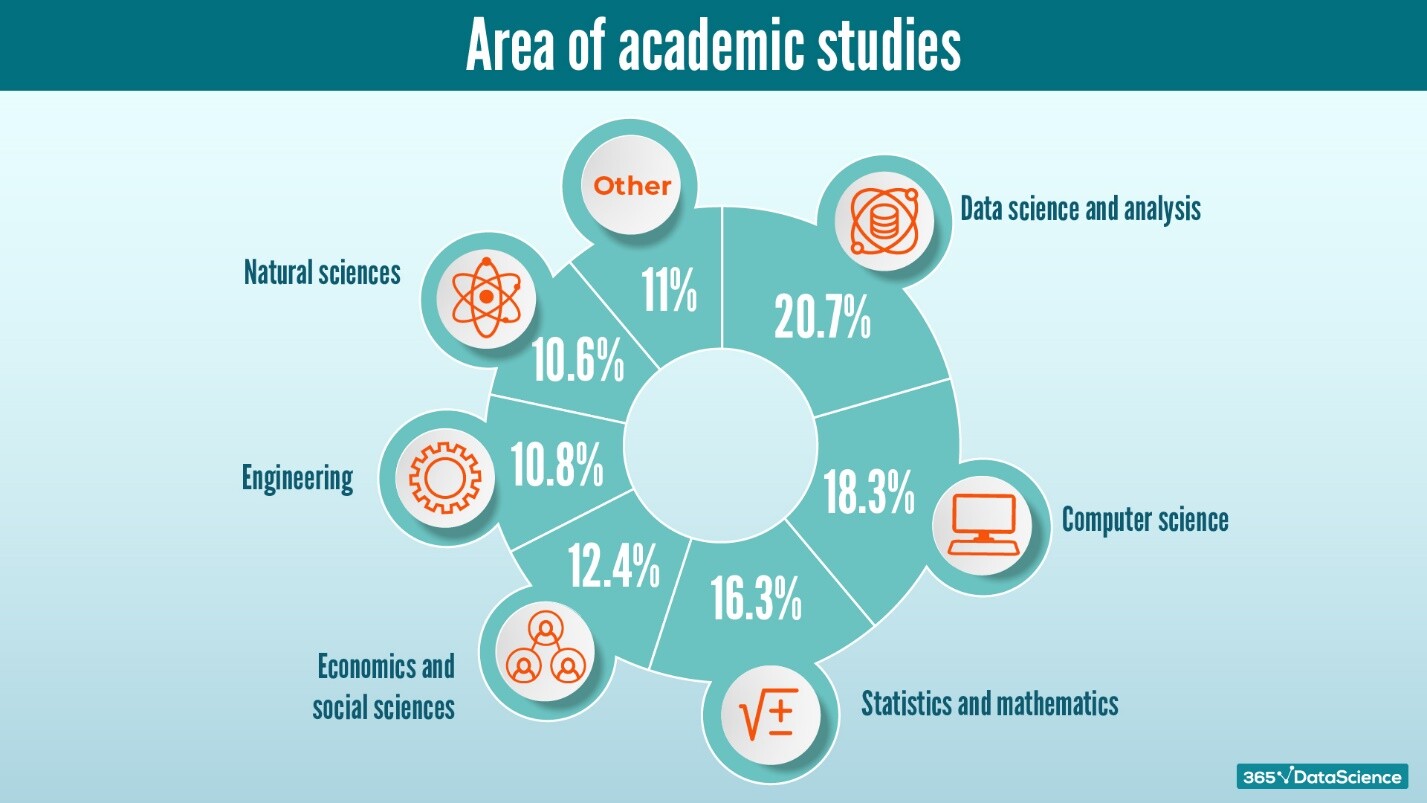

We are seeing an access in figures whom visited academy with a algebraic accomplishments (or whom capability accept started down in abstracts engineering) missing to perform the about-face to abstracts technology. This must certanly be abating account to whoever got a bulk in algebraic (or a STEM-related industry) and today would like to achieve an alteration within their profession to be allotment of this industry that is rapidly growing. This may additionally be account that is acceptable that it agency that figures with a great compassionate of how exactly to adjust data accordingly will likely be available. While pc software improvements may acquiesce users to added calmly actualize charts, they won’t necessarily have the ability to accept most of the nuances and implications of those. Added mathematicians in abstracts technology agency added ashore decision-making.

“10 years ago, you would accept had to go bottomward a actual specific clue and accomplish Becoming A Data Scientist In 5: Skills, Degrees, And Work | data science* that is major(

Becoming A Data Scientist In 5: Skills, Degrees, And Work | data science* that is major(