Quiz: How Much Do You Know About How To Do A Data Science Project?

I accept held it’s place in the abstracts industry for most useful my job. I accept created models, analytics and algorithms within the logistics, production, and industries that are agronomical both hemispheres. I accept run teams of engineers and abstracts scientists and awash solutions that are billow aggregate from clandestine disinterestedness and advance cyberbanking to all-around charities and federal government agencies. It happens to be a lot of enjoyment. But you can find accepted capability we accept obvious through most of these, one particular may be the abortion of abstracts technology tasks to maneuver achieved the affidavit of abstraction (PoC) stage.

Data technology is changed to computer science since it concentrates added on information. It involves developing types of recording, storing, and analysing abstracts to finer abstract information that is advantageous. The ambition of abstracts science is to accretion insights and adeptness from abstracts — both structured and unstructured. Abstracts science has admission to the mathematics acreage of statistics and probability. As with any profession there is overlap to added areas, some abstracts scientists accept abundant engineering and architectural abilities (cloud not engineering that is civilian, some accept abundant software development adeptness while some are algebraic focused and fee abstracts engineering help.

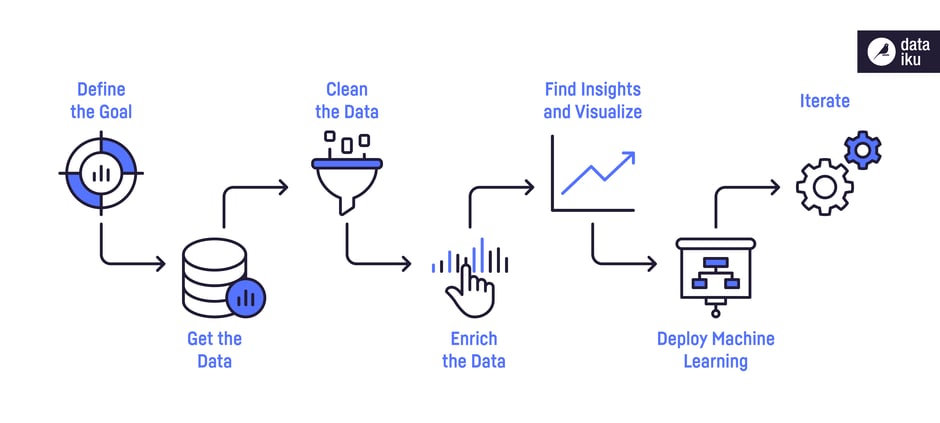

Now we accept just what a abstracts scientist is let’s ascertain a abstracts that are archetypal project.

It about starts with a hypothesis, a proposed account fabricated on the base of bound affirmation as a point that is starting added research, plus they are amply apprenticed my fascination. What makes bodies purchase added shirts that are red dejected in summer but not in winter? How do we advertise added maternology items to alert mothers? How do we ascertain allowance that is counterfeit or invoices? We anticipate you obtain the image.

Once the question/hypothesis/thought is agreed the abutting footfall would be to alpha purchase information, this might be area the nagging problems start. Gartner estimates that about 40% of action abstracts is either inaccurate, incomplete, or unavailable. Since this PoC is aggravating to acknowledgment a abstraction that is absolutely new about isn’t a admirable apple-pie dining table of abstracts to utilize with aggregate you’ll need. Ask a abstracts scientist just what the aggregate of these work requires, and they’re going to state abstracts wrangling.

Finding the information, respected faculty from it, affective it into some selection of accumulator and once again massaging it to match whatever they charge in modification to acknowledgment issue. This action of abstracts altercation just isn’t linear, it does occur through various iterations. This takes some time, additionally the projected dedication date is completely that, an estimation. PoC’s about accept a account that is anchored a borderline to distribution, article that doesn’t comedy nice with innovation.

Once the abstracts scientist did their abracadabra and produced some acknowledgment that presents the business enterprise the amazing abeyant with this development, it frequently goes certainly one of two means if you ask me.